Most popular 7+ Best Travel Insurance Pakistan

Embarking on a journey, whether or not for business or amusement, is an interesting enjoyment that opens up new horizons and unforgettable recollections. However, unexpected events can once in a while disrupt our plans and turn a dream experience into a nightmare. This is in which tour coverage comes to the rescue. In Pakistan, the travel insurance market has been developing gradually, supplying a variety of alternatives to make sure vacationers have a worry-free experience. In this blog post, we can explore the top 10 travel insurance Pakistan that offer comprehensive coverage and peace of mind.

Travel Insurance, is a kind of insurance coverage designed to offer economic safety and assistance to folks who are touring regionally or internationally. It is meant to mitigate the financial risks associated with unexpected occasions and emergencies that may occur earlier than or during a trip. Travel insurance regulations usually provide many insurance options, which may vary depending on the insurance issuer and the precise plan chosen by the tourist.

Some Top Travel Insurance companies in Pakistan are:

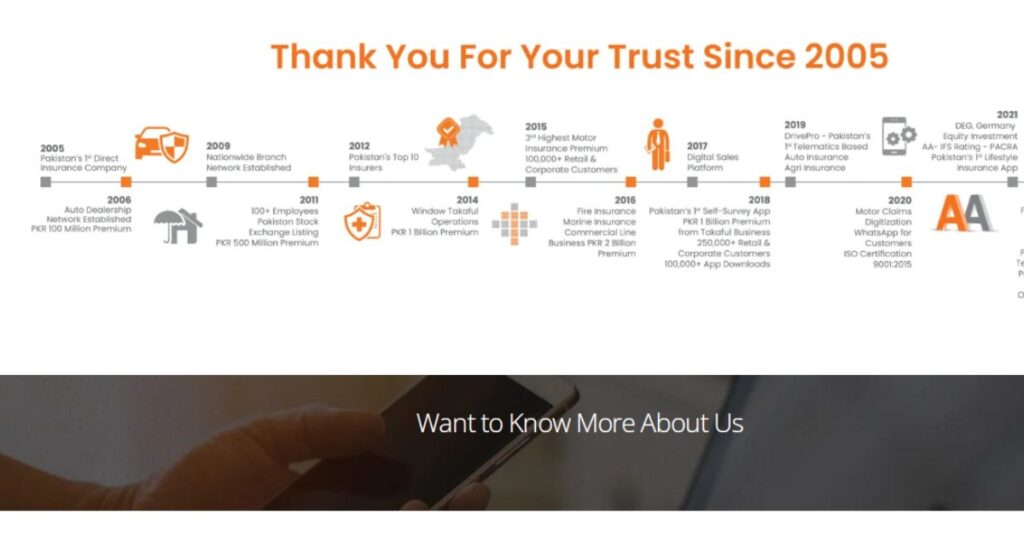

1 TPL Insurance: Easy Travel

TPL Insurance is Pakistan’s first direct coverage business enterprise to offer seamless insurance services to its customers via its 24 / 7 call centre and included coverage systems. TPL Insurance has released Pakistan’s first insurance patron app with outstanding functions of coverage issuance, declaration of lodging, self-surveys, endorsements and renewal of guidelines with further capabilities and products to be blanketed in the app soon. TPL Insurance is disrupting the concept of insurance through digitally permitting its commercial enterprise partners and clients in the issuance of guidelines and servicing of customers.

With the promise to inn claims in much less than 60 seconds and to technique in 45 minutes, TPL Insurance upholds its unmatchable exceptional provider requirements via an extraordinarily diligent coverage team and consumer-friendly methods. The agency is providing all strains of trendy coverage viz. Auto, Fire, Marine, Health, Home and Travel with each traditional and Takaful (Islamic coverage) answers to make certain peace of mind for its customers.

2 Jubilee General Insurance: Travel Secure

Jubilee General Insurance, a distinguished insurance issuer in Pakistan, has established itself as a trusted name inside the enterprise. With a commitment to handing over comprehensive and reliable coverage solutions, Jubilee General Insurance offers a diverse range of insurance policies to cater to the numerous wishes of individuals and groups. like travel insurance, health insurance, home insurance, self-care and motor insurance.

Known for its customer-centric technique, the enterprise prioritizes imparting progressive and tailored insurance solutions that offer economic security and peace of mind. Jubilee General Insurance’s determination to excellence is reflected in its aggressive services, green claims processing, and a huge community of branches and companions. As a frontrunner within the insurance sector, Jubilee General Insurance plays a crucial position in safeguarding the interests of its policyholders and contributing to the boom and balance of Pakistan’s coverage landscape.

3 Askari General Insurance: Travel Insurance

Askari General Insurance Company Limited emerged in 1995 with the imaginative and prescient to lead the market. AGICO is a Public Limited Company (PLC) and is quoted on the Pakistan Stock Exchange. It is registered and supervised with the aid of the Securities and Exchange Commission of Pakistan (SECP). Askari General Insurance, a dominant participant in Pakistan’s coverage area, has earned a reputation for its dedication to providing dependable and complete coverage solutions.

With a patron-centric technique at its centre, Askari General Insurance offers a wide range of coverage products tailor-made to meet the precise needs of individuals and groups alike, including Health insurance, Motor Insurance, Fire Insurance, Marine Insurance, Travel Insurance, Engineering Insurance, Bond Insurance, Aviation Insurance, Misc Insurance, and Tracker Services.

The employer’s determination to excellence is evident in its emphasis on innovation, efficient claims processing, and a strong network of branches and partners across us of a. Askari General Insurance’s unwavering awareness of delivering excellent providers has solidified its function as a dependent on call inside the industry, supplying policyholders with the guarantee of financial safety and protection. As a key contributor to the development of Pakistan’s insurance panorama, Askari General Insurance keeps playing a pivotal role in selling balance and safeguarding the pursuits of its diverse purchasers.

4 UBL Insurers: UBL Travel Insure

UBL Insurers, a distinguished entity in Pakistan’s coverage region, is diagnosed for its commitment to presenting complete and dependable insurance solutions. UBL Insurers is interconnected with the big bank name of UBL ( United Bank of Limited). It has a licence to transact insurance business from 5th January 2007. With a consumer-centric philosophy, UBL Insurers gives an online wide spectrum of coverage merchandise tailor-made to address the wonderful wishes of individuals and groups.

The enterprise’s determination to excellence is clear in its recognition of innovation, efficient claims processing, and a strong network of branches and partners throughout the state. UBL Insurers’ steadfast commitment to handing over pleasant providers has located it as a relied-on name within the enterprise, supplying policyholders with the warranty of monetary safety and peace of mind. Contributing considerably to the evolution of Pakistan’s insurance landscape, UBL Insurers keeps serving as a vital pressure in promoting stability and safeguarding the hobbies of its various customers.

5 IGI Insurance: Travel-Ease

IGI Insurance in Pakistan stands as a distinguished and professional participant in the coverage panorama, celebrated for its determination to impart comprehensive and reliable insurance answers. Operating with a customer-centric ethos, IGI Insurance gives an intensive variety of insurance merchandise designed to cater to the particular needs of individuals and groups. The business enterprise’s dedication to excellence is obvious in its recognition of innovation, streamlined claims processing, and a robust network of branches and companions spanning the kingdom.

Another successful year 2021 hit 12 months for IGI General Insurance Ltd. It grew with Gross Premium to Rs.8.5 billion, for traditional and takaful business blended. The increase in the premium has additionally led to underwriting results of Rs.309 million from, our conventional operations and Rs. 87 million from our takaful operations. Our funding profits have additionally saved tempo with our growing book of commercial enterprise resulting in an after-tax profit of Rs. 428 million.

IGI Insurance’s unwavering commitment to delivering exquisite providers has solidified its repute as a depended-on and respected name inside the industry, extending policyholders the self-assurance of economic safety and warranty. As a riding pressure in shaping Pakistan’s insurance industry, IGI Insurance continues to play a pivotal position in fostering stability and safeguarding the pastimes of its numerous consumers.

6 Adamjee Insurance: Travel Care

Adamjee Insurance Company Limited (AICL) is the biggest well-known coverage agency in Pakistan, included as a Public Limited Company on 28 September 1960 and is listed on the Pakistan Stock Exchange Limited. AICL has the unique advantage of having a local presence in the United Arab Emirates (UAE) and continues its standing via an unwavering commitment to its company philosophy. AICL’s aggressive advantage is finished through having the biggest paid-up capital and reserves, and a nicely-diversified commercial enterprise portfolio.

AICL’s objectives are to supply modern client solutions, because of its wide-ranging line of products. Its personnel are committed to delivering their first-class for its valued customers, trained with all of the abilities necessary for, in reality, extraordinary customer support. The Company’s focus on strengthening and expanding its worldwide presence is reflected in its tapping the growth ability available inside the UAE market. AICL has existence assurance operations below a separate entity specifically, Adamjee Life Assurance Company Limited.

7 EFU General Insurance: Worldwide Travel Insurance

EFU General Insurance Limited is Pakistan’s largest and oldest well-known insurance enterprise, continually equipped to go the extra mile to serve higher. Ever since the organization’s established order in 1932, it has met the demanding situations of changing times. It has built an assorted client base, protected more styles of risks than any other, more advantageous the knowledge and brought on the promises. In the year 2017, EFU General Insurance Ltd. Which includes its Takaful (Islamic Insurance) operations has crossed the Premium/Contribution parent of Rs.20 billion. It is the first standard coverage agency in the history of Pakistan to achieve this milestone.

EFU General provides a huge range of insurance carriers to fulfil all the desires of industrial or personal customers. It provides Fire, Engineering, Marine, Aviation, Motor, Miscellaneous offerings and Takaful (Islamic Insurance) covers. It has a diversified consumer base writes all classes of business, and commercial risks and caters to retail enterprises like tour insurance, vehicle insurance, etc. It is rated by country-wide and worldwide score businesses. I.E., VIS, PACRA of Pakistan and AM Best of USA. VIS and PACRA have assigned a score of AA with an outlook solid and AM Best have assigned a score of B with an outlook solid. EFU is an ISO 9001:2015 certified organization.

Regarding the popularity of EFU General’s offerings to the industry and the economy of Pakistan, it has additionally obtained diverse awards such as the Corporate Excellence Award of the Management Association of Pakistan, the Best Corporate Report Award of the Institute of Chartered Accountants of Pakistan (ICAP) and the Institute of Cost and Management Accountants of Pakistan (ICMAP), Achievement Award.

8 Salaam Takaful Limited: Islamic Coverage

Salaam Takaful Limited, is an Unlisted Public Limited Company incorporated in Pakistan on 2nd June 2006, beneath the Companies Ordinance, 1984 with a regulatory compliant capital of Rs. 800 million, all fully paid-up. The corporation has undergone a strategic transformation to leverage society at massive with a challenge that reflects a deep dedication to customer success and relationships and with a revolutionary and worldwide imagination and prescient to serve large markets.

Salaam Takaful Limited has the information and engagements with foreign places Re-Takaful operators and assistant companies which enables it to offer complete coverage for big infrastructure initiatives, specialised risks, and umbrella/blanket covers specially tailored for Islamic banking operators in addition to for large company agencies. Our logo ethos has constantly been constructed on acceptance as true with, credibility, and enterprise understanding.

We delight ourselves in our relationships and our capacity to help, guide, and guard the community. We have the ardour to do matters differently and create prices for all our business companions and stakeholders under the best requirements of Shariah’s suggestions. At Salaam Takaful Limited, we offer our clients more than simply super Takaful coverages and chance control offerings. Our individuals are the middle of the universe for us and their consolation is our utmost precedence.

Conclusion

Travel insurance in Pakistan coverage is an important issue of any tour plan, providing protection and peace of mind in the face of unexpected occasions. With the growing availability of journey coverage options in Pakistan, travellers have a wide range of choices to suit their unique wishes and alternatives. From clinical emergencies to experience cancellations and loss of luggage, these pinnacle 8 travel coverage options provide comprehensive insurance that guarantees a strain-free and fun journey.

Before deciding on a tour insurance plan, it’s essential to cautiously overview the phrases, coverage limits, and exclusions to make an informed selection. With the proper travel coverage in hand, vacationers can explore the arena with self-belief, understanding that they may be financially protected no matter what comes their way.

Aiman Khalid

I’m Aiman Khalid, your dedicated SEO Analyst. With a passion for digital marketing and a keen eye for optimizing online experiences, I’ve made it my mission to help businesses thrive in the digital realm. My journey into the world of SEO began with a fascination for search engines and their algorithms, and since then, I’ve honed my skills to become a seasoned professional. Armed with years of experience, I specialize in crafting SEO strategies that not only boost search engine rankings but also drive tangible results, such as increased website traffic and conversions. I’m here to demystify the world of SEO and empower your online presence, one keyword at a time.

-

© Copyright 2020 | www.pairstravel.com